How to Plan Buying a House

Introduction

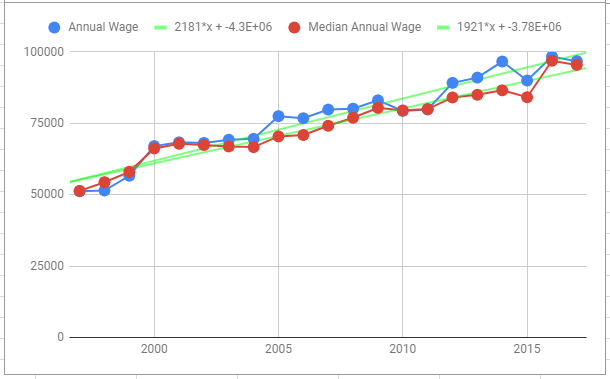

For most people, buying a first house is a milestone event in life and represents a major financial decision. In this project, we analyze the mathematics of three factors involved in buying a home: salaries, investments, and mortgages. As an example of our theory, we provide the scenario of a recent computer science graduate living and working in Denver, Colorado, who is planning to buy a house in 5 years.

Mortgages

A mortgage is a special type of loan for a house where the house is used for collateral, meaning that the bank owns the house if the leaser defaults on the loan. A typical mortgage starts with a downpayment of at least 3.5% of the houses value where the bank pays the remainder of the cost. Then, the leaser make predetermined monthly payments which pay off both the interest on the loan, and the principal, the actual price of the house.

| Year | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Salary | 97,477.48 | 99,398,08 | 101,318,67 | 103,239,27 | 105,159.87 |