| Line 9: | Line 9: | ||

=== Mortgages === | === Mortgages === | ||

| − | + | A mortgage is a special type of loan between the bank and you for a house. The loan works by providing the house as collateral, meaning that if you fail to pay off the loan, the bank takes your house. A typical mortgage starts with a "downpayment" of at least 3.5% of the houses value. If the house costs $100,000, then before receiving the loan one must pay at least $100,000 * 0.035 = $3500 first. The bank then pays the remainder of the house cost to the previous owners of the house. Over time, the loan works by paying both the interest and the principal - the original $100,000 cost of the house. | |

| − | + | ||

| − | + | ||

{| border="1" class="wikitable" | {| border="1" class="wikitable" | ||

Revision as of 14:10, 2 December 2018

How to Plan Buying a House

Introduction

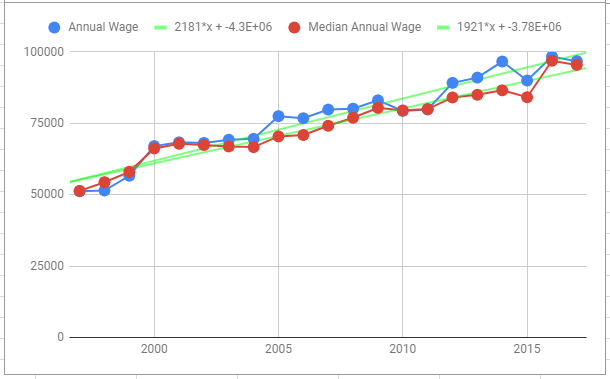

For most people, buying a first house is a milestone event in life and represents a major financial decision. In this project, we analyze the mathematics of three factors involved in buying a home: salaries, investments, and mortgages. As an example of our theory, we provide the scenario of a recent computer science graduate living and working in Denver, Colorado, who is planning to buy a house in 5 years.

Mortgages

A mortgage is a special type of loan between the bank and you for a house. The loan works by providing the house as collateral, meaning that if you fail to pay off the loan, the bank takes your house. A typical mortgage starts with a "downpayment" of at least 3.5% of the houses value. If the house costs $100,000, then before receiving the loan one must pay at least $100,000 * 0.035 = $3500 first. The bank then pays the remainder of the house cost to the previous owners of the house. Over time, the loan works by paying both the interest and the principal - the original $100,000 cost of the house.

| Year | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Salary | 97,477.48 | 99,398,08 | 101,318,67 | 103,239,27 | 105,159.87 |